AK 668-D 2001-2025 free printable template

Show details

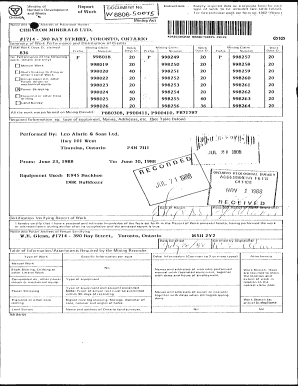

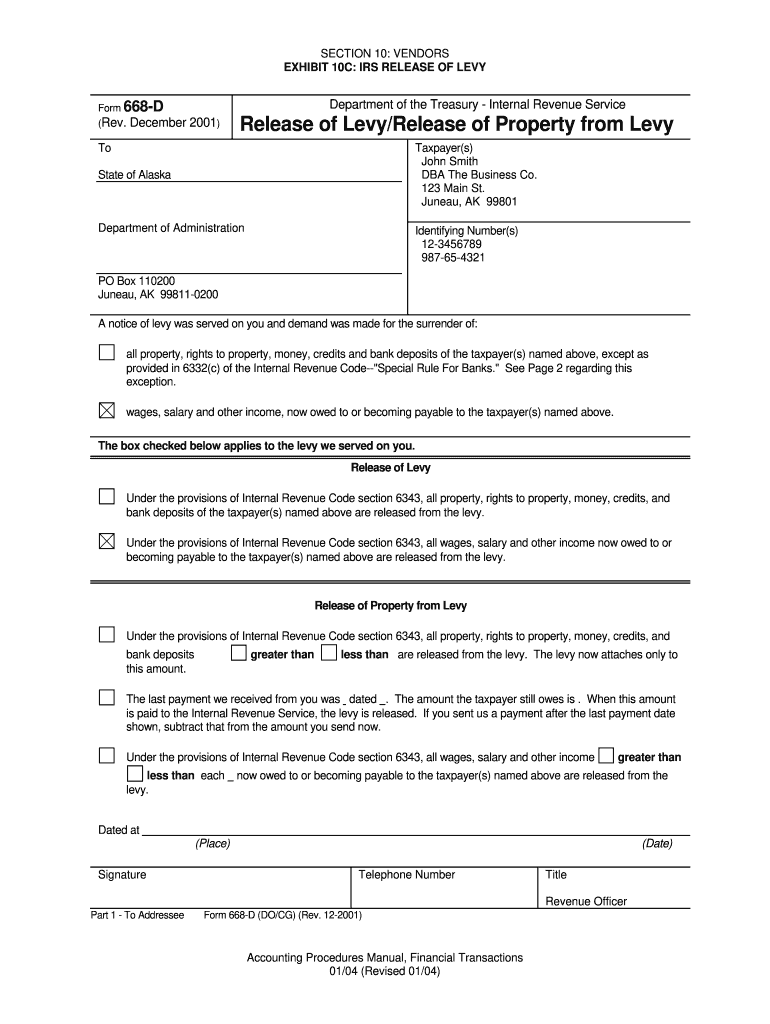

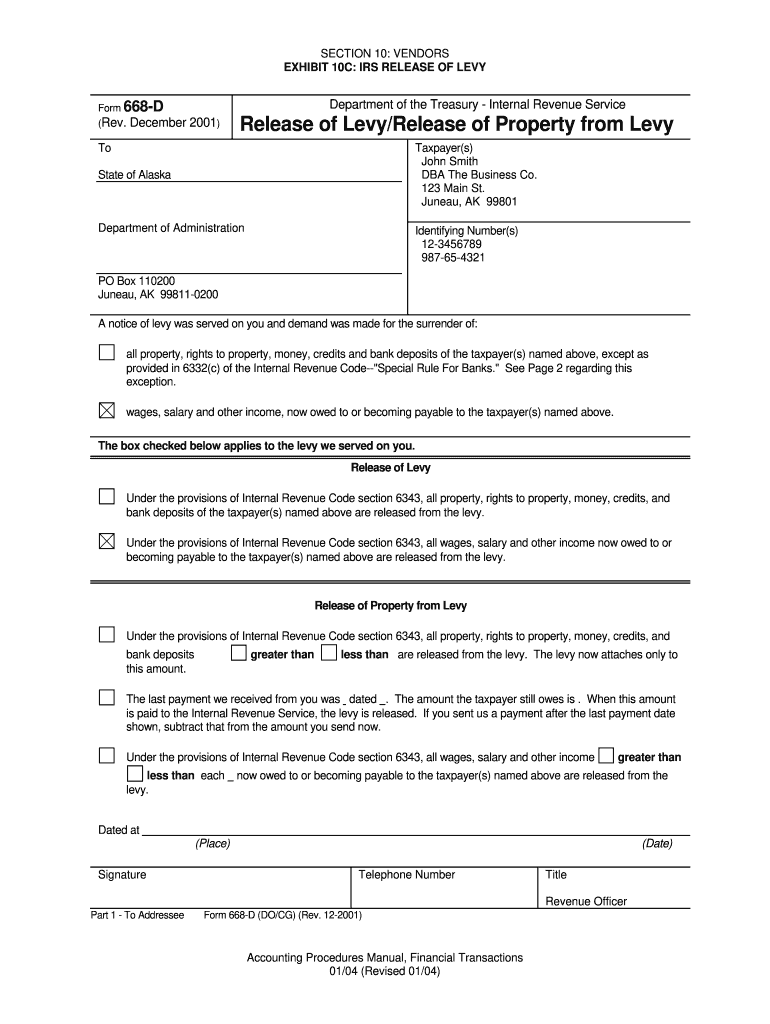

SECTION 10 VENDORS EXHIBIT 10C IRS RELEASE OF LEVY Form 668-D Rev. December Department of the Treasury - Internal Revenue Service Release of Levy/Release of Property from Levy To Taxpayer s John Smith DBA The Business Co. 123 Main St* Juneau AK 99801 State of Alaska Department of Administration Identifying Number s 12-3456789 987-65-4321 PO Box 110200 A notice of levy was served on you and demand was made for the surrender of all property rights to property money credits and bank deposits of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 668 d

Edit your irs form 668 d release of levy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 668d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 668 d pdf online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs form 668 d. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 668 d form

How to fill out AK 668-D

01

Begin by gathering all necessary personal information, including your name, address, and identification number.

02

Fill in the date and other relevant details at the top of the form.

03

Complete the section that requests information about the purpose of the form.

04

Provide any required documentation or additional information as specified in the instructions.

05

Review the form thoroughly to ensure all information is correct.

06

Sign and date the form at the designated area.

Who needs AK 668-D?

01

Individuals applying for a specific permit or license as outlined by the agency.

02

Businesses that need to report compliance with regulatory requirements.

03

Anyone seeking to update or correct information on an existing record or application.

Fill

668d

: Try Risk Free

People Also Ask about irs levy release form

What is a form 668 C final demand for payment?

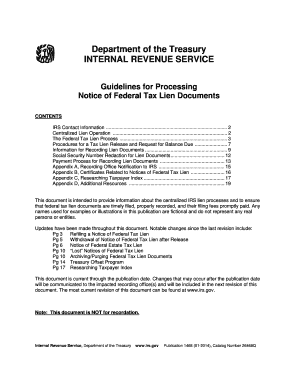

The Service issues a Form 668-C, Final Demand, when a levy source in possession of the taxpayer's property or rights to property has received the Service's Form 668-A, Notice of Levy, and has failed to respond timely.

What is a notice of levy form 668?

Form 668-A, Notice of Levy, is utilized by the IRS to seize funds in bank accounts, accounts receivable, and the cash value of life insurance from third parties holding assets for the taxpayer. The Levy attaches only to the funds/assets held for the taxpayer at the time the levy is received by the third party.

How do I respond to an IRS notice of levy?

If you receive an IRS bill titled Final Notice, Notice of Intent to Levy and Your Right to A Hearing, contact the IRS right away. Call the number on your billing notice, or individuals may contact the IRS at 800-829-1040; businesses may contact us at 800-829-4933.

How long does it take the IRS to stop a levy?

That hold is in effect for 21 days—a period during which you can act to stop the levy. After the 21 days have passed, unless the levy is reversed, your bank must transfer the funds to the IRS. If the initial bank levy does not satisfy the debt in full, the IRS can go back to your bank for additional monies.

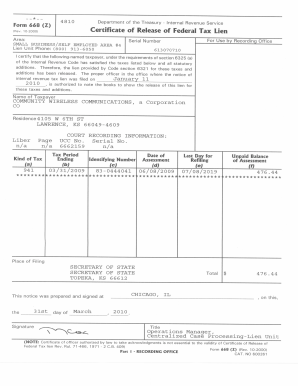

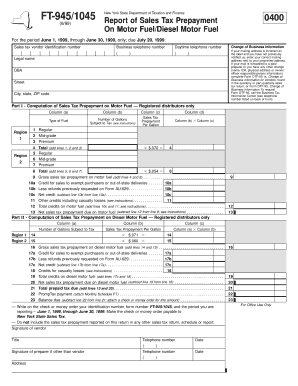

What is an IRS form 668 D?

A continuous wage levy may last for some time. When all the tax shown on the levy is paid in full, the IRS will issue a Form 668-D, Release of Levy/Release of Property from Levy. The IRS may also release a levy if the taxpayer makes other arrangements to pay their tax debt.

How do I dispute an IRS levy?

On the Form 9423, check the collection action(s) you disagree with and explain why you disagree. You must also explain your solution to resolve your tax problem. Submit Form 9423 to the Collection office involved in the lien, levy or seizure action.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 668 d form from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like irs levy form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out levy form using my mobile device?

Use the pdfFiller mobile app to fill out and sign form 668 w pdf. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out form 668 w on an Android device?

Complete bank levy release and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is AK 668-D?

AK 668-D is a form used for reporting specific information related to business activities in the state of Alaska.

Who is required to file AK 668-D?

Entities conducting business activities in Alaska, including corporations, partnerships, and sole proprietorships, are typically required to file AK 668-D.

How to fill out AK 668-D?

To fill out AK 668-D, individuals must provide accurate business information, financial data, and any required signatures. Detailed instructions are usually provided with the form.

What is the purpose of AK 668-D?

The purpose of AK 668-D is to collect information about business operations within Alaska for tax assessment and regulatory compliance.

What information must be reported on AK 668-D?

The form typically requires information such as business name, address, type of business, gross revenue, and other financial data relevant to the business operations.

Fill out your AK 668-D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 9423 is not the form you're looking for?Search for another form here.

Keywords relevant to bank levy irs

Related to form 668 a

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.